Why the U.S. Government Will Never Let Intel Fail: Semiconductors, National Security, and the New Era of Tech Sovereignty

Thursday, January 30, 2025Introduction: The Semiconductor Battlefield

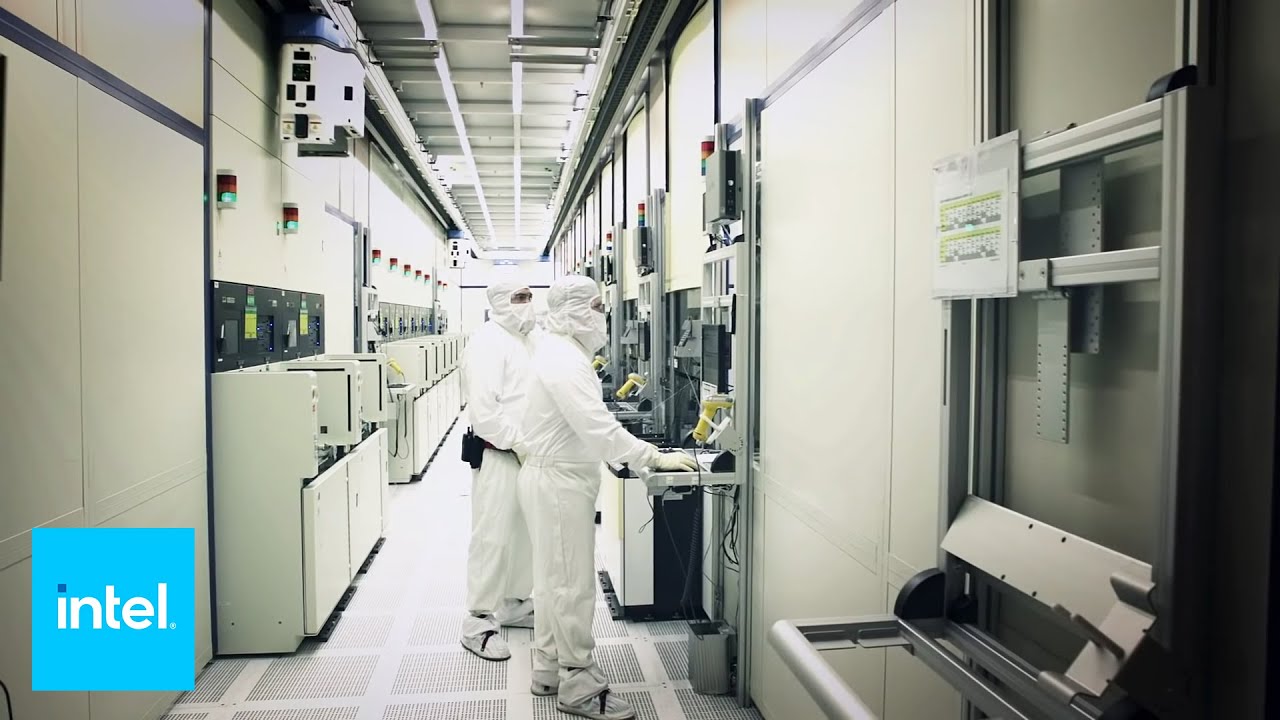

In an era where technology defines geopolitical power, semiconductors have become the 21st century's "oil." As of 2025, the U.S. government, under the Biden administration, has doubled down on its commitment to ensure Intel-America's semiconductor crown jewel-remains a global leader. This strategy isn't just about economics; it's a survival tactic in a world where China, Taiwan, and South Korea dominate advanced chip production. Here's why Intel is too critical to fail and how U.S. policy mirrors China's playbook to protect its tech giants.

Why Intel? National Security and the Silicon Shield

Intel's importance stems from its dual role as both a commercial powerhouse and a defense linchpin. The Pentagon relies on domestically produced chips for everything from AI-driven surveillance systems to hypersonic missile guidance. With China aggressively modernizing its military and investing $300 billion in its semiconductor sector by 2025, the U.S. cannot afford dependency on foreign foundries.

Key Reasons for Intel's Strategic Priority:

-

Defense Contracts: 60% of U.S. military systems use Intel-designed chips, including next-gen F-35 fighter jets and quantum computing projects.

-

AI Leadership: Intel's Gaudi 3 AI accelerators are critical for maintaining edge in machine learning, a field where China's Huawei and SMIC are catching up.

-

Supply Chain Control: Post-COVID-19 and Taiwan Strait crises taught Washington that offshoring chip production risks catastrophic disruption.

U.S. Policy in Action: CHIPS Act 2.0 and Beyond

The 2022 CHIPS Act was just the beginning. In 2025, the Biden administration rolled out CHIPS Act 2.0, allocating an additional 15 billion in grants and tax incentives to build cutting-edge fabs in Ohio and Arizona. These facilities will produce 2nm chips by 2026, closing the gap with Taiwan's TSMC and South Korea's Samsung.

Recent Moves (2025 Updates):

-

Export Controls Expanded: The U.S. tightened restrictions on selling advanced chipmaking tools to China, indirectly favoring Intel by stifling SMIC's 5nm ambitions.

-

"Buy American" Mandates: Federal agencies must source chips from U.S.-based fabs for critical infrastructure projects, locking in Intel's dominance.

-

Alliance Building: The U.S. pressured allies like Japan and the Netherlands to limit ASML's EUV lithography sales to China, ensuring Intel's tech stays ahead.

China's Playbook: A Mirror Image

Beijing's $50 billion investment in SMIC and Huawei's HiSilicon division reveals a parallel strategy. China's "Little Giant" policy nurtures homegrown champions to replace Western suppliers. For example:

-

SMIC's 7nm Breakthrough: Despite sanctions, SMIC achieved 7nm production in 2024 using older DUV machines, though yields remain low.

-

Huawei's Kirin Chips: Huawei's Mate 100 series (2025) uses 5nm Kirin processors, signaling China's slow but steady progress.

The U.S. recognizes that without similar state support, Intel could lose ground-a risk it's unwilling to take.

Criticisms and Challenges

While the policy safeguards national interests, critics argue it distorts free markets and strains international relations:

-

Market Distortion: Smaller U.S. firms like GlobalFoundries and Texas Instruments claim subsidies unfairly favor Intel.

-

Global Backlash: The EU and South Korea accuse the U.S. of protectionism, threatening retaliatory measures.

-

Costly Delays: Intel's Ohio fab, initially slated for 2025, faces delays due to labor shortages and permitting issues.

The Road Ahead: Tech Sovereignty or Tech Cold War?

The U.S.-China semiconductor rivalry is reshaping global trade. By 2030, experts predict two parallel tech ecosystems: one led by U.S.-allied nations and another by China. For Intel, this means guaranteed demand but also immense pressure to innovate faster.

What to Watch in 2025-2026:

-

Quantum Chips: Intel's collaboration with DARPA on quantum-resistant semiconductors.

-

AI Regulation: How U.S. limits on AI chip exports to China impact Intel's revenue.

-

Geopolitical Flashpoints: A Taiwan conflict could disrupt TSMC, making Intel's fabs irreplaceable overnight.

Conclusion: No Room for Failure

The U.S. government's stance is clear: Intel is more than a company-it's a pillar of national security. Just as China shields SMIC and Huawei, Washington will pour resources into Intel to maintain control over the silicon backbone of modern civilization. For investors and policymakers, the message is simple: in the tech cold war, semiconductors are the ultimate currency.