Tensorrent Relocates to the USA: Strategic Shift in AI Chip Manufacturing and What It Means for the Tech Industry

Sunday, February 02, 2025Introduction

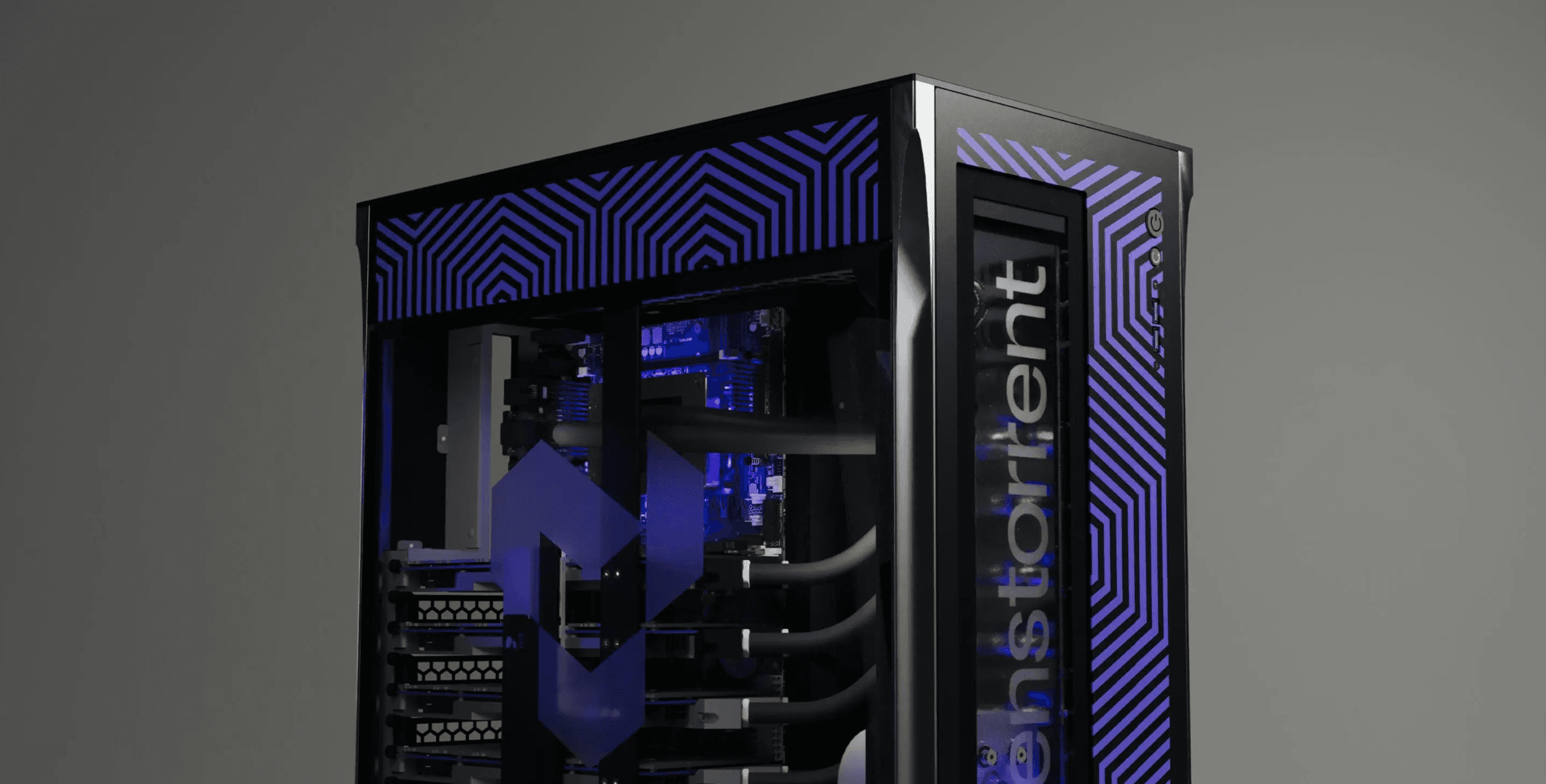

In a strategic move signaling the growing importance of reshoring critical technology infrastructure, Tensorrent, a rising star in AI chip design and high-performance computing solutions, has announced its relocation to the United States. The company, previously headquartered in Asia, is joining a wave of tech firms prioritizing geopolitical stability, access to talent, and U.S. government incentives like the CHIPS and Science Act. This article breaks down the implications of Tensorrent's decision, its potential ripple effects on AI development, and the broader race for semiconductor sovereignty.

Why Tensorrent Is Moving to the U.S.

1. Geopolitical Tensions and Supply Chain Resilience

The U.S.-China tech rivalry has escalated semiconductor manufacturing into a national security priority. Tensorrent's relocation aligns with efforts to reduce dependency on overseas foundries, particularly amid export controls and Taiwan Strait uncertainties. By establishing U.S.-based R&D and production facilities, Tensorrent aims to secure its supply chain for AI accelerators and data center chips.

2. Access to the CHIPS Act Incentives

The $52 billion CHIPS and Science Act is a major catalyst. Tensorrent likely qualifies for subsidies to build domestic fabrication plants (fabs), collaborate with U.S. universities, and accelerate innovation in AI-optimized hardware. This funding could help the company compete with giants like NVIDIA and AMD.

3. Proximity to Silicon Valley and Talent Pool

Relocating to tech hubs like Silicon Valley or Austin gives Tensorrent direct access to top-tier engineers, AI researchers, and partnerships with cloud providers (AWS, Google Cloud) seeking custom AI chips. The U.S. also offers stronger IP protection, a critical factor for cutting-edge tech firms.

Impact on the U.S. Tech Ecosystem

1. Boosting Domestic AI Chip Production

Tensorrent specializes in energy-efficient AI processors for machine learning workloads. Its U.S. expansion could reduce reliance on TSMC and Samsung for advanced node manufacturing, bolstering America's ability to produce next-gen chips for data centers, edge computing, and defense applications.

2. Job Creation and Economic Growth

The move is expected to create thousands of high-skilled jobs in semiconductor engineering, materials science, and software development. States offering tax breaks (e.g., Arizona, Ohio) may vie to host Tensorrent's facilities, similar to TSMC's $40 billion Phoenix fab project.

3. Strengthening National AI Capabilities

With the Pentagon and U.S. tech firms racing to outpace China in AI, Tensorrent's chips could power everything from autonomous drones to large language models (LLMs). This aligns with the Biden administration's push for "AI-ready infrastructure" outlined in its 2023 executive order.

Challenges Ahead

1. Navigating Bureaucracy and Costs

Building fabs in the U.S. is notoriously expensive and slow due to permitting delays and environmental regulations. Tensorrent will need to balance CHIPS Act funding with the reality of higher labor and operational costs.

2. Competition in a Crowded Market

The company faces fierce competition from established players (Intel, NVIDIA) and startups like Cerebras. Differentiating its AI chips through performance, pricing, or niche applications (e.g., quantum computing hybrids) will be critical.

3. Talent Shortages

Despite Silicon Valley's appeal, the U.S. semiconductor industry faces a shortage of 90,000 workers by 2030. Tensorrent may need to invest heavily in STEM partnerships and visa programs to attract global experts.

What's Next for Tensorrent?

Industry analysts speculate that Tensorrent's U.S. pivot could lead to:

-

Government Contracts: Partnerships with DARPA or the Department of Energy for AI-driven defense and energy projects.

-

IPO Plans: A stateside presence may position the company for a NASDAQ listing, following the path of ARM Holdings.

-

Sustainability Focus: Leveraging U.S. labs to develop low-power AI chips aligned with federal green tech initiatives.

Key Takeaways

-

Tensorrent's relocation underscores the strategic reshoring of critical tech sectors amid global instability.

-

The CHIPS Act is reshaping the semiconductor map, with the U.S. aiming to produce 20% of advanced chips by 2030 (up from 0% today).

-

AI hardware innovation will accelerate, benefiting industries from healthcare to autonomous systems.

FAQs

Q: When will Tensorrent complete its U.S. move?A: While timelines are undisclosed, industry insiders predict operational U.S. fabs by late 2025.

Q: How does this affect consumers?A: Long-term, it could stabilize AI chip prices and availability for gaming GPUs, data centers, and smart devices.

Q: Will Tensorrent collaborate with U.S. universities?A: Likely. Partnerships with MIT, Stanford, or Georgia Tech could drive R&D in neuromorphic computing and AI algorithms.

Conclusion

Tensorrent's relocation to the U.S. marks a pivotal moment in the global semiconductor arms race. By aligning with national priorities and tapping into America's innovation ecosystem, the company positions itself as a key player in shaping the future of AI infrastructure. As the tech world watches, this move could inspire more firms to follow suit-solidifying the U.S. as the epicenter of next-gen computing.